Depreciation recapture calculator rental property

Your actual tax on the sale at a profit seemingly for federal purposes will be some combination of depreciation recapture taxed at. 135000 x 002576 34776.

How To Fill Out Schedule E Rental Property On Your Tax Return Youtube

Depreciation recapture Realized gain The realized gain is taxed as ordinary income Tax Realized gain Depreciation recapture tax rate If the realized gain accumulated depreciation.

. You collect rent monthly. Say you owned the rental for ten years and depreciated the property at the standard 3636 each year. Ad With Decades Of Experience Let Cornerstone Help With Securitized 1031 Replacement Today.

The depreciation expense of 1818180 is recaptured by the IRS and taxed at the investors ordinary income rate up to a maximum of 25. Ad Get A Free No Obligation Cost Segregation Analysis Today. Deprecation recapture is an important tax event that happens when you sell an investment property.

The annual depreciation deduction lowers the taxable ordinary income. Your depreciation recapture gain is 102560. 6 Multiply your capital gain by the capital gains.

Property Can Be an Excellent Investment. Calculate Understand Your Potential Returns. If the investor is in the 22 federal income tax.

Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. Your depreciated value would look like this. To calculate the depreciation cost of a property divide the basis cost by the recovery period which is 275 years for residential income properties.

Rental property provides an investor with several potential passive income streams. You earn equity in your home. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

Your investment property appreciates over time. May 31 2019 451 PM. This means that you deduct 1275 of the purchase price of the building onlynot the landevery year.

Reduce Your Income Taxes - Request Your Free Quote - Call Today. The total amount of tax that the taxpayer will owe on the sale of this rental property is 015 x 155000 025 x 110000 23250 27500 50750. If your taxable income is 496600 or more the capital gains rate increases to 20.

Cornerstone Combines The Power Of 1031 Securitized Real Estate. This is known as the. For residential property the federal depreciation period is 275 years.

Property 1 days ago Depreciation Recapture Rental Property Calculator. A rental property depreciation calculator can be a great tool for investors looking to find out the depreciation on their rental property. For a married couple filing jointly with a taxable income of 280000 and capital gains of.

Ad AARPs Calculator is Designed to Examine the Potential Return From an Investment Property. Reduce Your Income Taxes - Request Your Free Quote - Call Today. Ad Get A Free No Obligation Cost Segregation Analysis Today.

In this instance your capital gain on the property is 152560 102560 50000. This is how much you can. Remember the percentage of depreciation is represented mathematically two places from the decimal point when calculating.

The investors guide to rental property depreciation recaptureRentals Details.

14249 Schedule E Disposition Of Rental Property

Like Kind Exchanges Of Real Property Journal Of Accountancy

Can I Not Claim Depreciation On My Rental Property

Understanding Rental Property Depreciation 2022 Bungalow

Rental Property Depreciation Rules Schedule Recapture

Tax Benefits Of Accelerated Depreciation On Rental Property

Rental Property Roi And Cap Rate Calculator And Comparison Etsy Rental Property Rental Property Management Income Property

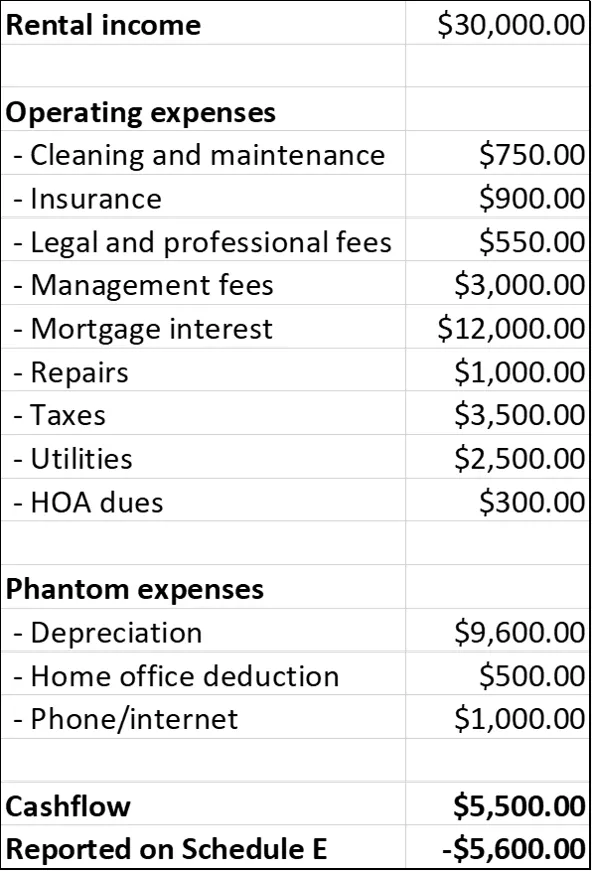

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Form 4562 Rental Property Depreciation And Amortization

How To Calculate Depreciation On Rental Property

Tax Treatment Of Sale Of Rental Property Youtube

Investing Rental Property Calculator Mls Mortgage Real Estate Investing Rental Property Rental Property Management Real Estate Rentals

Should You Sell Or Rent Your Home Before A Military Move Military Move Buying First Home Rent

Reasons To Keep Your Rental Property On Q Property Management

Rental Property Depreciation Rules Schedule Recapture

Depreciation Recapture What It Is How To Avoid It In 2022 Capital Gains Tax Irs Taxes Savings Strategy

Selling Your Rental Property At A Loss